A House of Representatives subcommittee Wednesday took testimony, but took no action, on legislation to extend a long-term agreement for the Caneel Bay Resort at Virgin Islands National Park/NPS

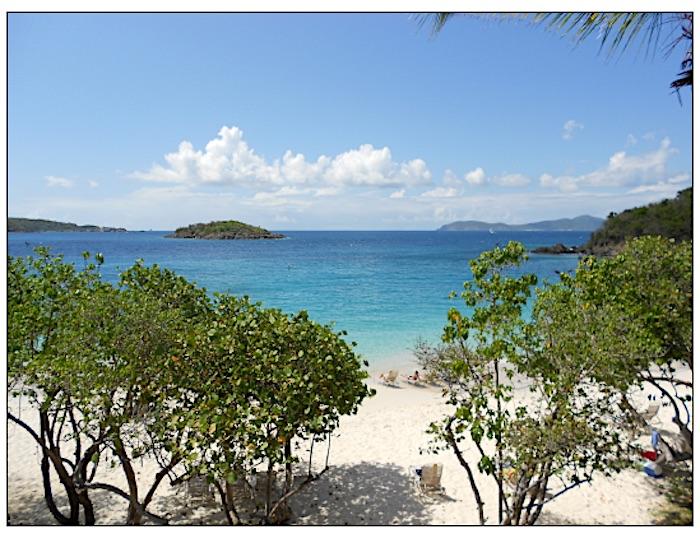

On a hot, humid New York City day in September 1983, Laurance S. Rockefeller signed away, for just $1, a beautiful sweeping parcel of ocean-front land on the Caribbean island of St. John to the United States government for inclusion in Virgin Islands National Park.

Mr. Rockefeller, a philanthropist and conservation giant whose support of the national parks movement spans the country from Acadia National Park in Maine to Redwoods National and State Parks in California, fell in love with St. John during a cruise in the Caribbean. In 1956, he purchased 5,000 acres and gave it to the government for the park's creation, but held back about 170 acres on the island's northwestern shore, the Caneel Bay Plantation, to create a resort.

Twenty-seven years later, on September 13, 1983, he signed the acreage over to the Interior Department, but crafted a "Retained Use Estate" to allow his resort to operate through September 2023. In that RUE document, he made clear his intent that the facilities eventually would become property of the national park.

It is Grantor’s expectation and intention that at some future time, to be determined by Grantor pursuant to the provisions set forth herein, the Retained Use Estate will be terminated and extinguished in order to carry out the longstanding objective of Grantor that the Premises ultimately be an integral part of the Virgin Islands National Park under the jurisdiction of the Secretary for the use and enjoyment by visitors to the Park of the outstanding scenic and other features of national significance located both within the Premises and in other areas of the Park.

While the resort's operation under the RUE was assumed in 2004 by CBI Acquisitions, LLC, which was bound by the RUE's guidelines, last fall's hurricanes, Irma and Maria, and "the art of the deal," seem to have upset Mr. Rockefeller's notarized intent of seeing the facilities go over to the park.

Back in 2010, Congress passed a law directing the National Park Service to study whether a more typical concession lease agreement similar to those used across the National Park System should succeed the RUE. Three years later the Park Service released a draft environmental assessment in favor of such a change. But efforts between the Park Service and CBI Acquisitions to come to terms on a lease so far have been fruitless.

Gary Engle, who sits on the executive committee of the holding company that controls the Caneel Bay Resort, says he wants an arrangement of at least 60 years to hold onto the property/House video feed

Though five years still remain to get the deal done, U.S. Rep. Stacy Plaskett, D-Virgin Islands, and Gary D. Engle, a member of CBI's executive committee, told the House Federal Lands Subcommittee on Wednesday that not enough time remains for CBI to reach a lease with the Park Service, raise the estimated $100 million for rebuilding the heavily damaged Caneel Bay Resort, and restore the resort's reputation as a high-end luxury destination where nightly rates start at $600.

"What had been a full-service luxury beach resort amidst the beauty of St. John was reduced to mostly rubble," testified Mr. Engle. "With no resort of visitors to service, hundreds of employees were terminated in one day with no way for us to promise when, or if, the jobs would return."

While CBI wants to rebuild the resort, the executive continued, "if Caneel Bay is to be rebuilt, a sufficiently long-term and commercially reasonable agreement is necessary. In the amount of required capital and time required to redesign and rebuild, and the time required to reestablish a resort in a highly competitive marketplace, a minimum 60-year term is necessary."

At the National Parks Conservation Association, staff say the legislation in effect caters to a single private interest and places the National Park Service at a severe disadvantage in terms of protecting the park's resources and when it comes to being adequately compensated.

"This bill risks resource damage and would not only counter the advice of the managing agency for the safekeeping of the national park, but the intentions of the park champion and founder, Mr. Rockefeller, whose interest was in the long-term health of Virgin Islands National Park," reads a portion of NPCA's position statement on the bill, a document that was sent to the House subcommittee on Tuesday.

"In addition, if the RUE were to be reevaluated, as was recommended in the 2013 draft EA, the likely financial return to the park would be far greater than the meager 1.2 percent (which is potentially vulnerable to deductions based on needed repairs or other 'adjustments') of gross revenues at the resort, as proposed in H.R. 4731," the document said. "Finally, concessionaire contracts, the most common type of agreement for facilities like the Caneel Bay Resort in national parks, which utilize their remarkable park locales for excellent fiscal returns, undergo a competitive bidding process and are frequently required to provide NPS with a percentage significantly higher than 1.2 percent."

Mr. Engle's testimony came on Rep. Plaskett's bill to provide that 60-year window by extending the RUE. The congresswoman testified that Hurricanes Irma and Maria last September devastated the Virgin Islands and that that her bill "addresses the need for urgent action to sustain employment" on St. John.

"The hurricanes did us no favor, and St. John took the largest physical blow," the Democrat added. "My constituencies need expedited job security."

Prior to the hearing, which ended without action being taken on the legislation, Rep. Plaskett and her staff failed to respond to Traveler inquiries seeking explanation why she was going against the Park Service's wishes to support a concessions-type arrangement, and the congresswoman didn't specifically address that during Wednesday's hearing, other than to say five years was not enough time to complete lease negotiations. She also said her legislation would provide the necessary window to enable CBI to raise the $100 million and restore the resort's lustre. She did not address the possibility of an RUE extension just long enough to enable the lease negotiations to be completed.

While the resort does have insurance to help pay for the rebuilding, CBI Acquisition's marketing director, Patrick Kidd, told the Traveler last week, though he was uncertain whether it would cover all the costs, and Mr. Engle did not say whether it would. Nor did he explain what the $100 million above the insurance coverage would be used for, raising the possibility that CBI wants to expand its facilities somehow.

National Park Service staff, in the EA completed in 2013, voiced various concerns over continuing to operate the resort under the RUE, in part because it didn't prevent resort expansion.

"(T)here is a risk of damaging resources at the resort since NPS would not be involved in the management of the resort before the expiration of the RUE. The RUE owner could undertake construction or other actions that may result in resource damage or loss," the EA said.

The document also said there could be impacts to land use, archaeology, cultural and historic resources, and species such as sea turtles and corals if the RUE remains in place. However, it also said there could be negative socio-economic impacts if the property was managed as a concession and a new concessionaire reduced employment levels.

"Culturally, Caneel Bay contains historic resources, and it reflects Rockefeller’s vision of a close community of man and nature," the Park Service said in the EA. "It also contains numerous archaeological resources and is under consideration by NPS for listing in the National Register of Historic Places as an historic district."

Under the proposed legislation, CBI Acquisitions, LLC, which in 2004 took over the RUE from the Jackson Hole Preserve, a nonprofit entity the Rockefellers had created to pursue their conservation interests, would pay just 1.2 percent on gross annual revenues to the Park Service. Mr. Engle told the subcommittee that that percentage represented fair market value based on an appraisal of similar resort properties.

That percentage is far less than other lodging concessionaires in the National Park System pay the government. For instance, at Grand Canyon National Park, the NPS sought a 14 percent franchise fee for concessionaires seeking to operate lodges on the South Rim before settling for 8 percent. At Gulf Islands National Seashore, the Service sought a 9.2 percent franchise fee on retail operations. At Yellowstone, the franchise fee is 4.5 percent, but the concessionaire also has to provide a 6 percent annual contribution to a maintenance account.

While Park Service officials in Washington, D.C., couldn't say what the average franchise fee was for lodging concessions in the park system, Chief Spokesman Jeremy Barnum did say that "the average is 7.5 percent across all services."

The income difference from Caneel Bay for the federal government can be sizeable depending on the rate charged. According to Rep. Plaskett, the Caneel Bay Resort generates $65 million a year.

Rep. Raul Grijalva, D-Arizona, pressed Mr. Engle on his opposition to a lease arrangement for the property.

"Eight years have passed, a lease deal hasn't been signed, could you tell the committee what are the major sticking points in this eight-year process that we haven't reached agreement," asked the congressman.

"Well, it's purely been one of time," responded Mr. Engle. "The bill was passed in 2010, it took the National Park Serivce to produce the lease document, the lease document was not submitted for discussion for over three years. And, as you can imagine, it was very complicated."

"But there are substantive points that have also been at issue, other than the three-year time lag," interjected Rep. Grijalva.

"We never really got into a substantive discussion," said Mr. Engle.

"And five years is not enough to finish this substantive discussion at this point?" replied the congressman.

"We, basically, never had a discussion on the substance," the businessman said.

Rep. Grijalva then asked if it would be helpful if the 2010 law, which allowed for a 40-year, non-competitive lease for CBI, was revised to provide for a 60-year lease.

"Given it's taken us eight years and we have not made any progress towards a lease, I think we'd be sitting here talking about this for quite a while," replied Mr. Engle.

Rep. Donald McEachin, D-Virginia, questioned the 1.2 percent payment contained in Rep. Plaskett's legislation, saying that to his knowledge "it was far below typical payments for other national park lodging opportunities."

Mr. Engle said the appraiser that arrived at that percentage was approved by the National Park Service. While the range of rates the appraiser cited in its 800-page report fell between 1 percent to 3 percent of revenue, the businessman said that, "recognizing that we were going to have to spend a significant amount of capital, using the appraisal as a guideline, I proposed this 1.2 percent, which I thought was in the range of fair market value and also reflected the fact that this was going to be a very expensive rebuilding process."

While Rep. McEachin voiced the opinion that 1.2 percent was not a significant enough percentage to keep CBI from simply walking away if the resort sustains similar hurricane damage in the not too distant future, Mr. Engle replied that not only does he treasure the location, but that "running the resort as we did, and as I think we can, has a positive return on capital."

"In other words, I can make money, which is my line of business," he said. "I can make money running the resort. That is a substantial incentive."

Comments

Wouldn't the easiest way to evaluate motives in this be to examine campaign finance donations?

As much as I love Caneel Bay Resort, I found my soul here, Mr. Rockefeller's intention Must be honored.

I hope this bill & stacey plasket fall flat on their faces. ABSOLUTELY ROCKEFELLER'S WISHES MUST BE HONORED. HE OWNED IT, SHE DOES NOT, GAVE IT TO THE NPS. PERIOD.

This comment was edited to remove gratutious comments.--Ed.

honor the dream and wishes of laurance rockefeller the man who gave this beautiful treasure to the people of the world to be preserved for all time. please save caneel bay and the virgin islands national park.